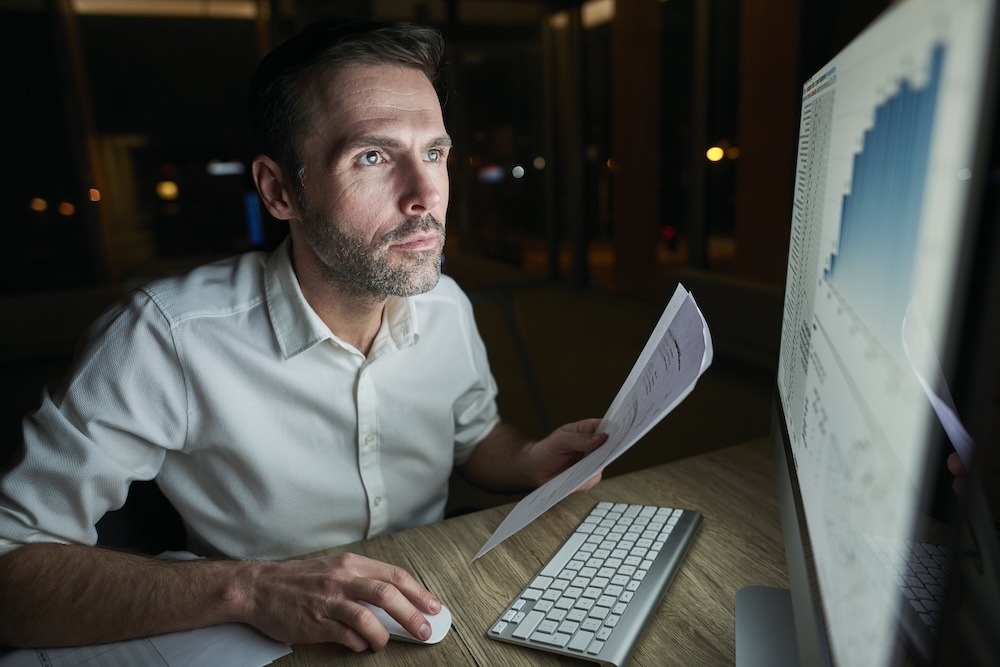

When you’re deep in the day-to-day of running a pharmacy—dispensing scripts, answering patient queries, chasing deliveries—it’s easy to push the numbers aside. After all, you didn’t become a pharmacist to stare at spreadsheets. But if there’s one thing I’ve learned after years in the business, it’s this:

If you don’t know your numbers, you don’t really know your business.

The Pharmacy Balancing Act

Most pharmacy owners wear many hats: clinician, manager, HR, problem-solver. But the one role that often gets neglected? Business owner.

And like any business, pharmacies live and die by cash flow, margins, and profitability. You can be doing 5,000 items a month and still lose money if your buying prices are off, your costs are bloated, or your service income isn’t pulling its weight.

What makes it even more urgent today is the pressure we’re under:

- Tight buying margins

- NHS clawbacks

- Low uptake of private services

- Heavy reliance on low-margin NHS dispensing

All of this means there’s little room for error. If you’re not tracking your numbers closely, you could be working hard and still falling behind.

So, What Should You Actually Track?

Let’s keep it real and practical. Here are a few numbers that every pharmacy owner should keep an eye on:

- Monthly Revenue: How much is coming in? Break it down by NHS, private, OTC, and services.

- Gross Profit Margin: What’s left after you pay for the medicines/products sold? This helps you measure your buying efficiency.

- Net Profit: After all expenses (rent, wages, utilities), are you actually making money?

- Cash Flow: Are you regularly short at month-end, or do you have enough buffer to breathe?

- Average Transaction Value: Are people just picking up prescriptions, or also buying health products, skincare, or add-on services?

Real Talk: What Happens When You Don’t Know?

I’ve seen it happen. Pharmacies running on fumes because they didn’t realise their wage bill crept up or that their service income wasn’t covering costs. A pharmacy isn’t just a healthcare provider—it’s a business that needs to be financially healthy to serve its community well.

The Bottom Line

You don’t need to become a finance guru overnight. But you do need to take ownership of your numbers. Even reviewing a few key metrics once a month can transform your decision-making.

In this upcoming series, I’ll break down each of these numbers and show you how to track them simply—even if you’re not a “numbers person.”

Because the truth is, the more you understand your numbers, the more confidently you can grow, adapt, and lead your pharmacy toward long-term success.

Let’s take the guesswork out of business—and replace it with clarity.